![]()

Disclaimer: Sponsored post. I use to be in the financial industry, so being able to stress Financial Literacy makes me very happy! All opinions in this post are my own.

The month of April is financial literacy month, and Enza’s Bargains is excited to be partnering with Massachusetts Mutual Life Insurance Company to help you take small steps to secure the financial future they want. Finances can be overwhelming and scary but MassMutual wants to remove the fear from this subject and help you move towards a better path. We’ll discuss their 6 steps and I’ll explain how we’ve taken these steps in our house. I promise if you commit some time to this you’ll feel so much better!

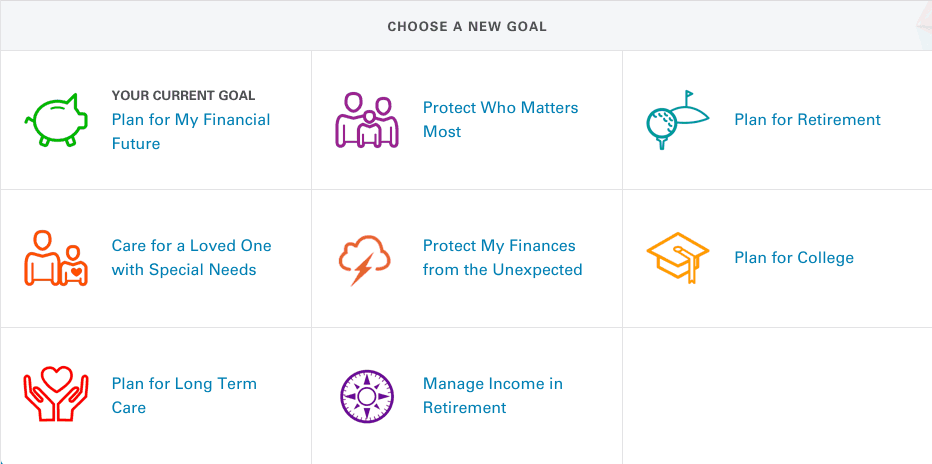

Mass Mutual has six steps to help identify where you are, where you’re going and how to achieve your goals:

- Identify your financial goals

- Get Organized

- Use tools to help you project your savings needs

- Consider your most valuable asset and how it affects your future.

- Teach your kids early

- Find the right people to help you

- Identify your financial goals

For us this was easy, we sat down and discussed where we are right now and where we want to be in five years. We then discussed what changes we could make that would set up a savings schedule that would allow us to achieve this goal

- Get Organized

Organizing yourself is so important and will eliminate a lot of the stress from this process. Have you ever reached the end of your paycheck and been baffled by where your money went? Setting up a simple budget tracker will help you identify black holes in your budget. For us it was our caffeine fix. Once we saw just how much we were spending we both took steps to make our “habit” easier to afford

- Use tools to help you project your savings needs

Regardless of if your goal is a new car, a new house, your kids’ college or retirement…or all of the above, how much can you afford to set aside for that now and how long will that take you? There are many tools out there to start a simple tracker. You could also sit down with a trusted advisor and find more complex ways to achieve your goal. We’ll discuss that a little more on step 6. In our current situation the hubby and I find ourselves, we’re simply putting away all we can to get towards our goal!

- Consider your most valuable asset and how it affects your future

Our home is our most valuable asset. Not only is it our most expensive purchase ever, it’s also where Enza’s Bargains is operated. Losing the house would be devastating, but going through this step gave us a backup plan for both our family and Enza’s Bargains! So never fear, even if a tornado came and swept our little house away, I’d be able to quickly update you and keep telling you about great values and savings!

- Teach your kids early

This step is so much fun because the kids really enjoy it, usually. Talking to your kids about your budget can both help them learn about how your money is spent, it also helps us keep from having tantrums in the toy aisle. When your kids understand how much money you have and where it has to go, they begin to understand that you can’t buy anything you want.

- Find the right people to help you

Remember you can’t do this alone. Finding someone that you trust and can speak your language. Being financially sound is a team effort and getting the right “coach” will make everything so much easier!

Again starting this process can sometimes be daunting, but I guarantee once you sit down and take the steps to set up your goal and path to reach that goal you’ll feel so much better. And don’t forget to visit MassMutual for amazing tips, tools and advice!

This is a sponsored post written by me on behalf of MassMutual.

Ashley S says

Thanks for the info! There is a lot to consider when making financial decisions.

Crystal says

Those are great tips for financial success. I need to set up some new goals for myself, and get a plan going.

Mandee says

Great tips! I absolutely agree with teaching your kids early! We have little bill organizers and I like to show my children exactly how things work…without going into too much detail. So many children don’t even know how to balance a check book—yikes! Thanks for sharing! 🙂

Crystal says

I need to pick up some bill organizers. I would love to have something tangible to show the kids when we discuss financial decisions.

Jeannette says

These are all great tips! I also used to be in the financial industry and it’s so important to make small daily changes that will add up to a big difference!

Robin Rue (@massholemommy) says

My husband is an accountant, so he’s obviously really good with money. He takes really good care of our personal finances.

Stacie @ Divine Lifestyle says

Everything counts when you’re making a financial decision. What you do now can help you or hurt you down the line.

Nancy @ Whispered Inspirations says

Thank-you for the information. I always research before I make any changes or financial decisions.

Ashley Sears says

Love these tips. As a former banker and loan officer, I know first hand how important financial tips like these are!

Andrea Kruse says

The amazing thing about having children is all the bills and financial responsibility that comes along with parenthood! I am determined this year to find a better system to be organized, and I need #6 – find people who are more knowledgeable than me to help. Great list!

Travis says

The importance of teaching kids financial responsibility early cannot be overstated. It is one of the most important lessons that any parent can teach.

Little Miss Kate says

This is VERY timely! I just emailed my financial planner to set up a meeting this morning. It is time to evaluate our education savings for our kids again, and also look at the impact a job change would have on our retirement savings.

Alli says

I firmly believe that children should be taught about personal finances as early as possible. My husband and I have financial goals and I love the feeling when we achieve one of our goals.

Jeanine says

Wonderful tips! I think we do really well with our money. We could stand to save a bit more, but other than that we are good!

Olivia Schwab says

These are great tips! I’d love to be able to achieve my financial goals! Hopefully my student loans won’t be soo bad… Thanks for the tips!

lisa @bitesforbabies says

I appreciate how concise, easy to understand, and simple to follow these rules are! Thanks for the informative post!

lisa says

These are great tips. We are finally in a good place financially but it took a number of years to be where we wanted to be!

Crystal Green says

These are some really good tips. I think anybody can find a benefit from them. I personally need to really jump on the band wagon and do this.

Rosey says

It is important to seek help if you need it. You’re right though, it’s got to be the ‘right’ help or you could end up worse off.

Chubskulit Rose says

I have heard about MassMUtual but we do financial transaction with other company. Having an accountant husband, these tips are very familiar.

Carolann says

I can also appreciate tips and advice like this. I was so bad with finances so I’m always looking for ways to improve. thank you!

Krysta says

Money saving can be very hard, but thankfully there are tools are there that can help! Especially in this day and age of apps and technology there are so many useful things to help people stay on track! So important!

Shaney Vijendranath says

I love this. I’m going to make time to sit and do this properly. Really need to work on my financial goals.

Roselynn Mercedes says

My husband and I definitely need help managing out financials once in a while. Every few months we have an accountant come in and take a look at everything to make sure we’re on the right path.

Bonnie @ wemake7 says

Being organized certainly does help. I’m pretty good with finances but of course always wish we had more money.

Ann Bacciaglia says

This is a great post. These are all great tips. I am lucky and i have a Brother in Law that is an accountant.

Lynndee says

Thank you for the tips. The hubs and I have financial goals and we are trying our best to reach those goals.

HilLesha says

Insightful post, and I agree with you – teach children early. I learned the value of a dollar at a very young age. It has helped me avoid many financial pitffalls.

Cara (@StylishGeek) says

I am rally loving the financial education campaign that MassMutual is doing! I’m already bookmarking the Retirement and College Savings links! Thanks for sharing!

Krystal says

I wish I could hire an accountant to help get me in shape financially! Thanks for the tips – I so need to get organized.

Manu Kalia says

I really need this one, Organizing my financial is my weakness. Glad you shared this one. Thank you for sharing!

CourtneyLynne says

these are such great steps!!!! I wish my parents would of taught me about finances at a young age, so I will definitely be teaching my daughter

Debi says

Getting organized and figuring out where I wanted to be was the biggest part of me. Now it is just following through.