Disclaimer: Sponsored post by ShopAtHome and TurboTax. All opinions are my own! This was one of my favorite posts and parties to have!

What do you get when you get a group of friends together to discuss how to save money on taxes? You get a “happy you year” party! A lot of people dread doing taxes, including myself. So when I invited friends to attend this TurboTax party, I was surprised on how many friends used Turbo Tax. I even had one friend talk about how when they tried it with another company and then switched to Turbo Tax, how they saved more money! When I told them about food, games, and talking about saving money they were all excited to attend!

During the party we had some great conversations sponsored by TurboTax!

Save Money on Taxes – 10 Most Overlooked Tax Deductions Edits

- State and Local Sales Tax Deductions: If you live in a state that doesn’t have state income tax, you can now choose whether to deduct state income tax or state local sales tax. (Don’t worry TurboTax will figure it out for you!)

- Out-of-Pocket Charitable Contributions: Don’t forget about the little charitable gifts you made during the year. The little things add up. Did you buy ingredients for a casserole you prepared for a non-profit? Did you buy stamps for a fundraiser? Did you drive your car for charity because that is $0.14 a mile?

- Student Load Interest: In the past, if parents paid back a student load, no one got a tax break. Now, if mom and dad pay back the load, the IRS treats it as though they gave the money to their child, who then paid the debt. You could get up to $2,500 in interest paid by you or your mom and dad!

- Moving Expenses to Take First Job: If you moved more than 50 miles to take your first job, you can deduct 23.5 cents a mile (plus parking fees and tolls)!

- Child and Dependent Care Credit: Don’t forget if you paid for a babysitter or daycare you can claim this!

- Earned Income Credit: 25% of taxpayers fail to claim it according to the IRS. This is a refundable tax credit not a deduction. It ranges from $496-$6,143 and depends on your income, marital status and family size. If you missed it in the past, you can go back up to 3 years to claim it!

- State Tax You Paid Last Spring: If you paid taxes then you get to itemize and deduct these too!

- Refinancing Points: If you refinanced to a 30-year mortgage there are some more deductions you don’t want to miss.

- Jury Duty paid to Employer: Since the IRS demands that you report these, if you had to give the money to your employer then you have the right to deduct the amount so you aren’t taxed on money that just passed your hands.

- Reinvested Dividends: TurboTax Premier and Home & Business tax preparation solutions include a cool tool to help figure these out!

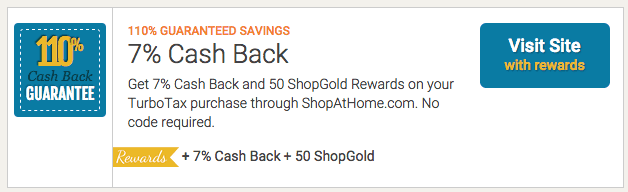

Save Money on TurboTax by Using ShopAtHome.com

Do your taxes through ShopAtHome.com and get 7% back from what you purchase from TurboTax & save 25%!

Throwing a Tax Party

I called a local restaurant that had a game room and they let me use it when they opened! I ordered some appetizers for everyone! We had:

–Spinach and Arti-tax Tips

–Chips and Cheese Tips

–Mozzarella Sticks

–Turbolicious Potato Skins

Some of us played darts & shuffleboard! We all then shared those tax tips above! Every party guest left with a fun TurboTax savings card, a tax organizer, and tips on how to save! Plus, my friends who were there that have used TurboTax in the past talked about how easy and simple it was to use them and how much they loved it! So SCORE!!

Thinking about throwing your own tax party or financial advice get together, do it! It will be awesome and very useful!

Take action and start your taxes now! Don’t forget about the 7% Cash Back & 25% off TurboTax from ShopAtHome.com! (They also have a FREE version to do your taxes!)

susan says

Wow what a run time! I have never used them before for my taxes, but I think I will be trying them this year.

Andrea Kruse says

Cute party! I love any excuse to get together with friends. We love Turbo Tax and will be using it again this year. Though most of those gems don’t apply to us, I had no clue about a few of them. Moving expenses? Never knew! 🙂

Ellen Christian says

That is good to know. I will have to check out some of these when I do my taxes.

Cinny says

Ugh, I’m so bad with taxes. I’ll keep these tips in mind!

Jenn says

These are great tips! I think a lot of people don’t realize how many tax deductions are available! I love the idea of Tax party to share tips!

Andrea says

Love this idea! Did my taxes today on Valentine’s day using turbo tax and got it over with! Love turbotax and they had a deal that I didn’t have to pay for state taxes!

Andrea

http://Www.phdfashionista.com